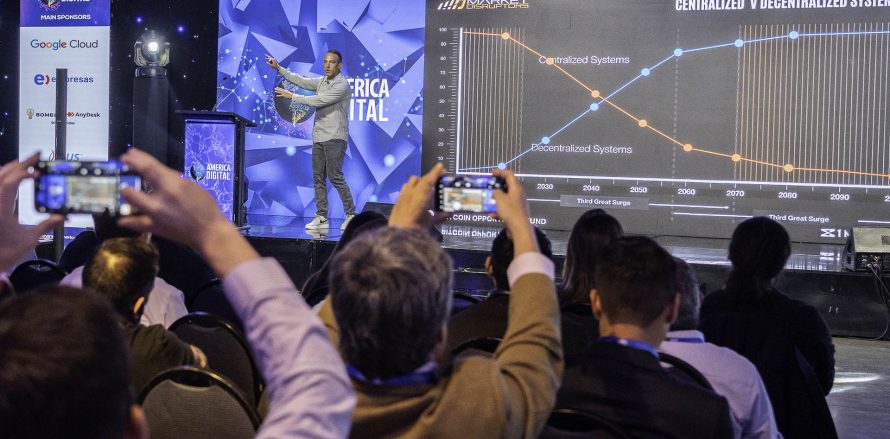

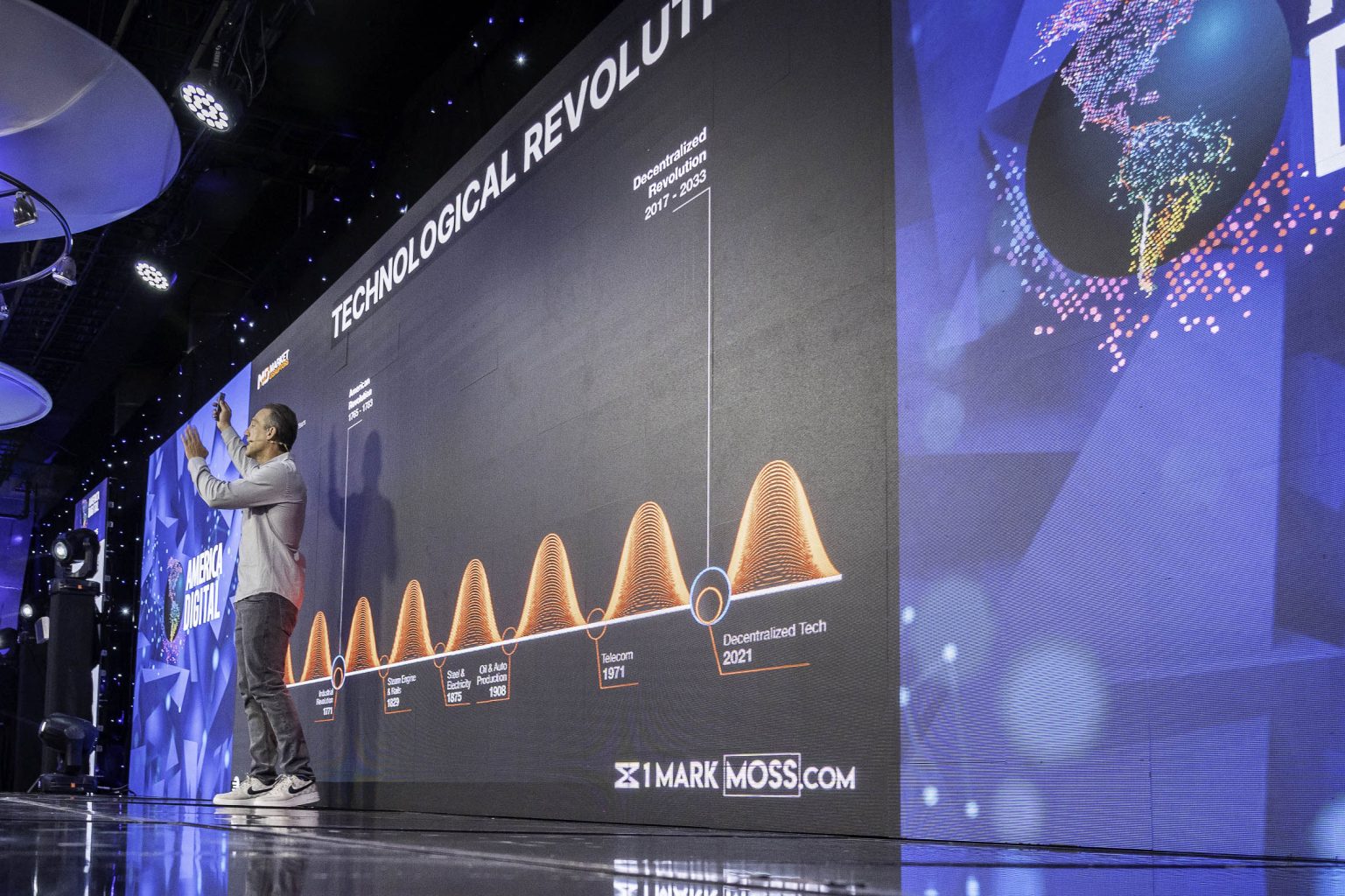

As you explore the dynamics of the sixth technological revolution, it’s essential to understand how emerging technologies, particularly decentralized systems, are reshaping financial sovereignty. This era is marked by a transformative shift akin to past revolutions that changed human civilization.

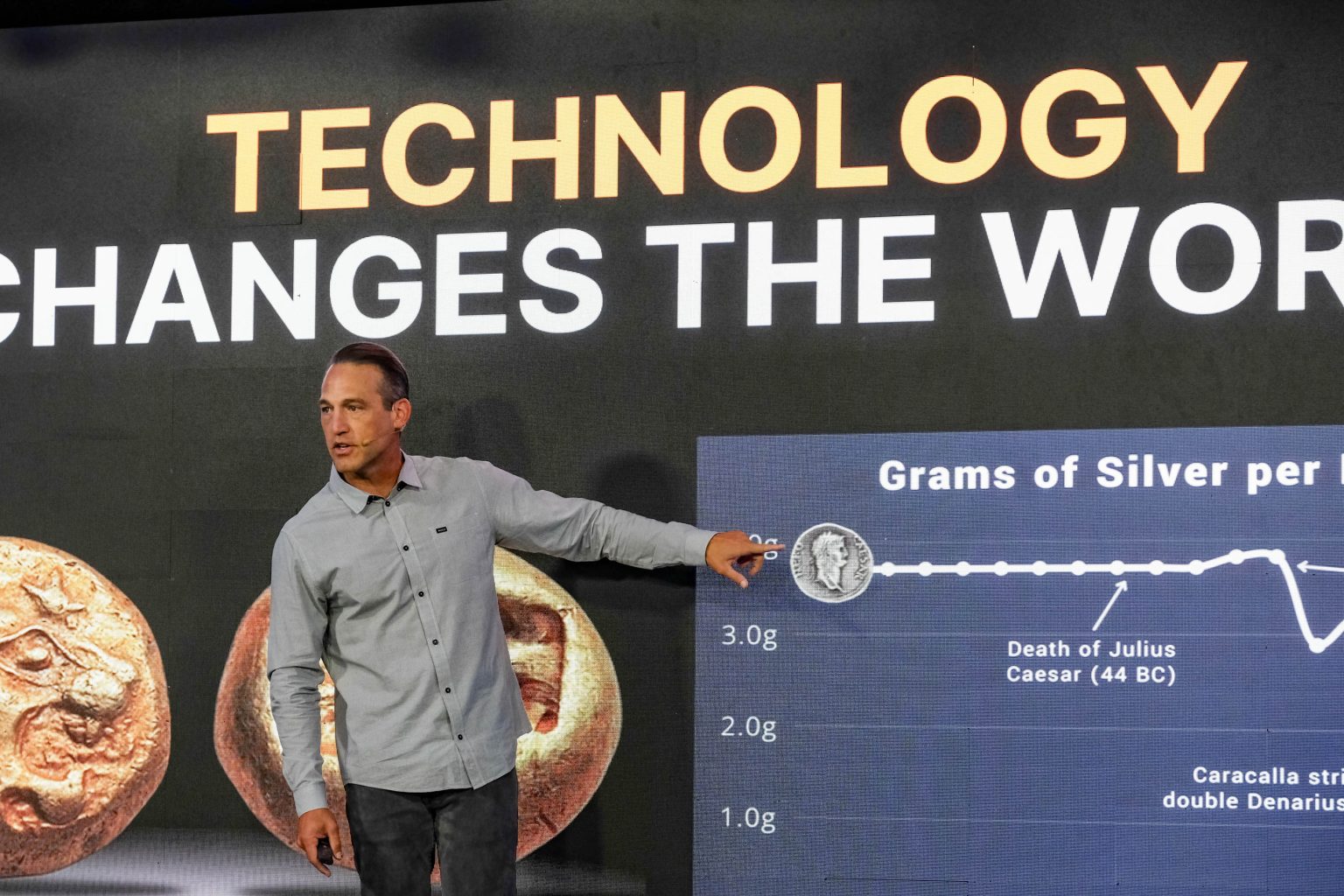

As Mark Moss, a top 10 Bitcoin and macroeconomic educator, emphasizes, «It’s always technology that changes the world.» This revolution, centered around decentralization, offers new opportunities and challenges that you need to navigate.

The Evolution of Financial Systems

Throughout history, technological advancements have consistently transformed financial systems. Moss points out that «humans create, have ideas, solve problems, and so we create things.» The invention of coins in the fifth or sixth century BC marked a significant milestone. However, trust issues plagued this system, as people needed to verify the coin’s value and authenticity.

The Roman Empire attempted to solve this by minting coins with consistent silver content, but eventually, they debased the currency to meet financial demands. «We trusted the government in this new technology coins, but they stole all the money,» Moss explains. This pattern of trust and betrayal has repeated with various financial instruments, from coins to paper money.

Technological Revolutions and Their Impact

Each technological revolution has reshaped society and financial systems. The introduction of double-entry accounting in Venice during the Renaissance, for example, revolutionized trade by enabling secure transactions without physically moving gold. Moss notes, «Instead of having to move money across or send gold coins across a continent, the ledger just says, well it moved from this person to this person.»

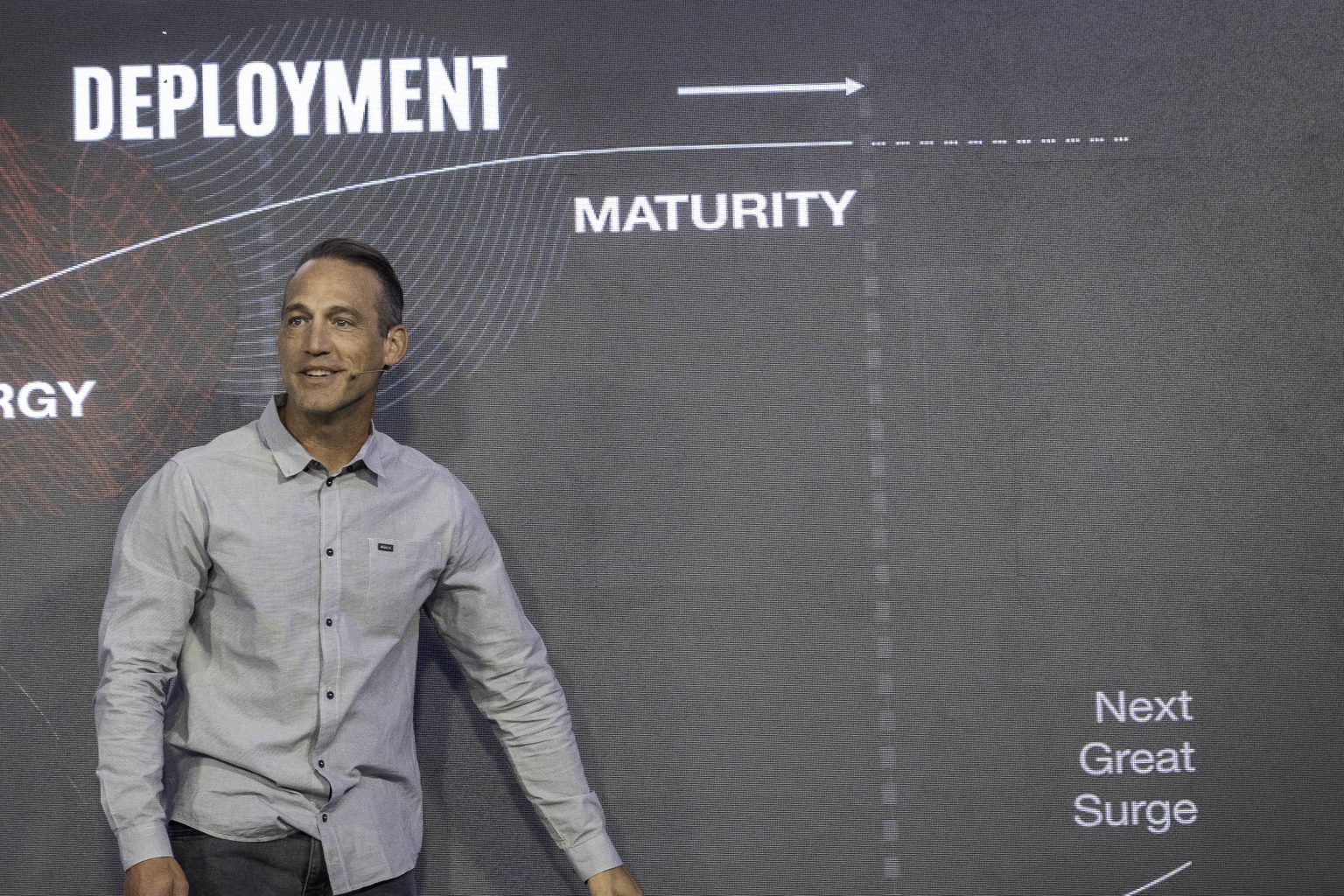

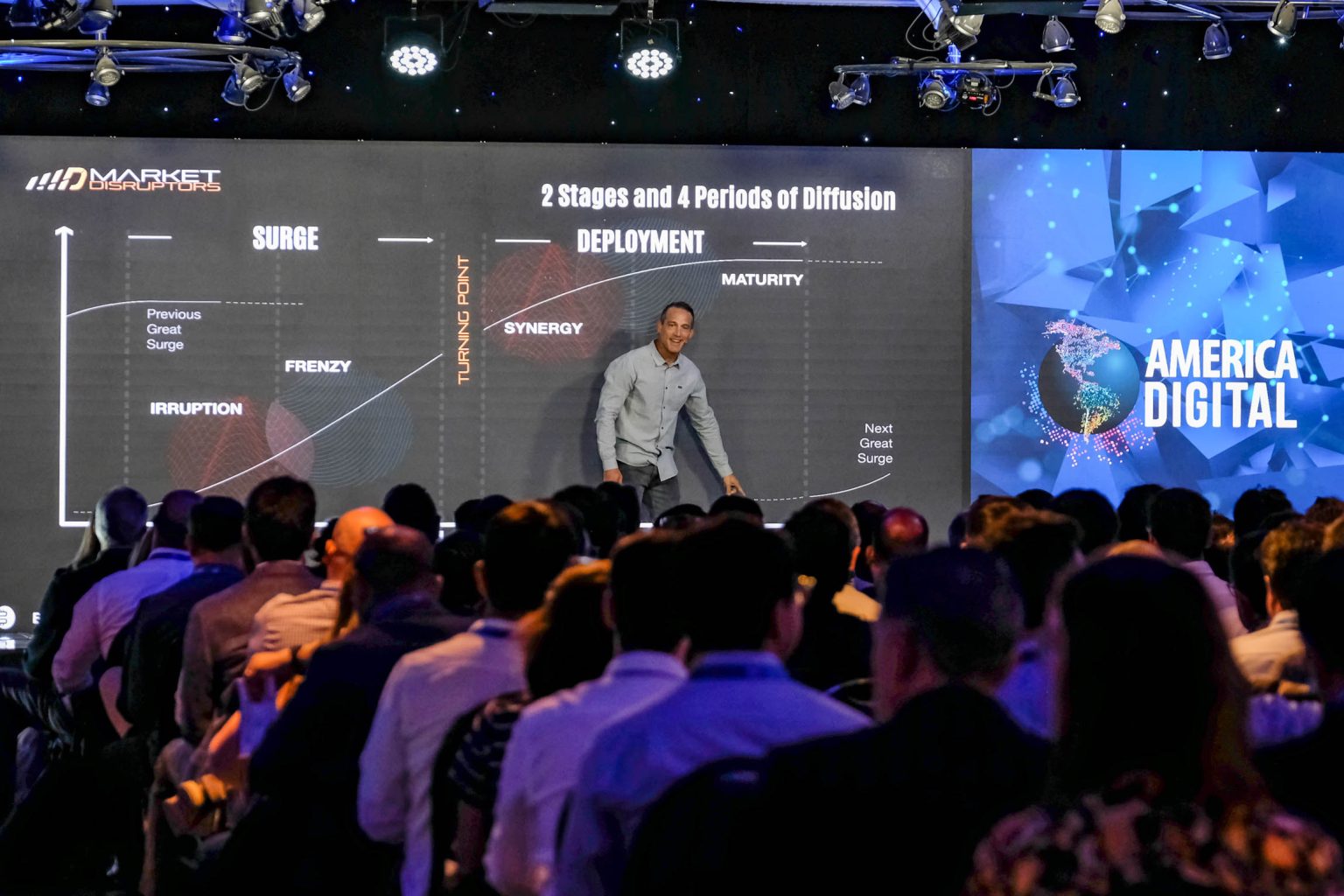

The decentralization brought about by gunpowder and the printing press broke the control of feudal systems and centralized churches, respectively. This theme of technology driving decentralization continues today. According to Moss, «Every 50 years we have what’s called a technological revolution,» leading to significant shifts in power and economic structures.

The Rise of Decentralized Systems

Today, we are witnessing the rise of decentralized systems, driven by technologies like blockchain and Bitcoin. Moss argues that Bitcoin represents a «zero to one moment» in financial technology. Unlike traditional financial systems controlled by centralized authorities, Bitcoin offers a decentralized ledger that is secure and trustless.

The traditional financial system’s reliance on centralized ledgers introduces numerous issues, including trust, permission, and censorship. «Whoever controls the ledger for your ID, for your land property title, or for your money controls it,» Moss warns. Bitcoin and other decentralized technologies provide solutions by distributing control and enhancing transparency.

Embracing the Decentralized Revolution

The decentralized revolution offers you a chance to reclaim control over your financial destiny. Moss highlights that «problems equal solutions,» and as long as there is creativity and innovation, there will be new ways to overcome challenges. In this new era, understanding and leveraging decentralized technologies can help you build and protect your financial sovereignty.

In conclusion, as you navigate the complexities of modern finance, embracing decentralized systems like Bitcoin offers a path to greater financial independence and security. This technological shift not only transforms how we manage money but also empowers you to protect your financial sovereignty in an increasingly digital world.

Noticias Recientes

- Gen presente en el 10° Congreso Latinoamericano America Digital 2025

- La visión de monday.com sobre la IA: revolucionando la productividad para todos

- Google Agentspace: Llevando agentes de IA y búsqueda impulsada por IA a las empresas

- Argentina y CESSI llevan su talento tecnológico a America Digital

- Entrevista CNN, Lesley Robles, America Digital, La IA como motor de cambio